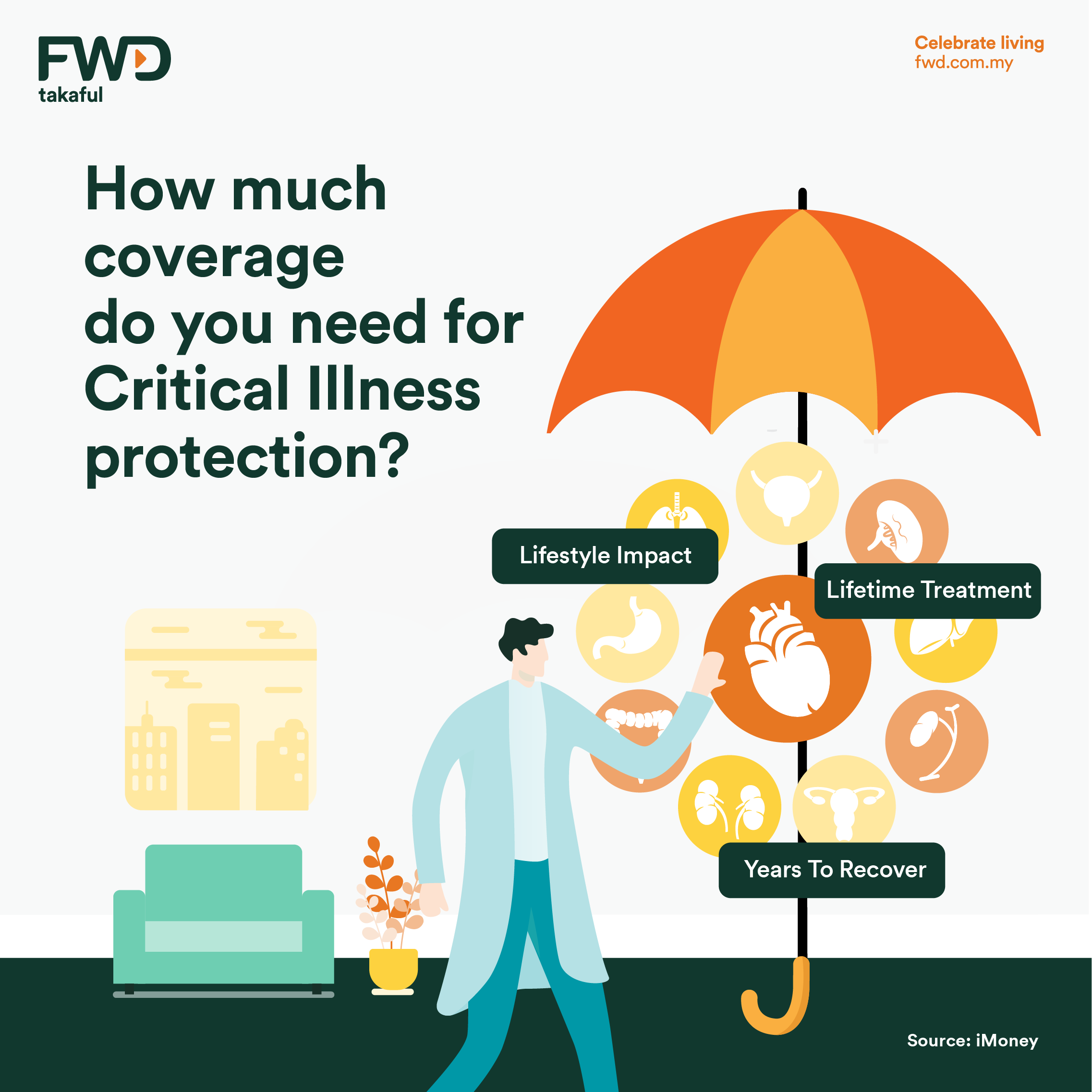

Critical illness coverage is not the same as your hospitalisation and surgical coverage which is commonly referred to as your medical card. For most critical illnesses, treatment and recovery can typically take several months to several years. Here are some of the things you should consider when deciding how much to cover for critical illnesses:

- Analyse medical costs such as hospitalisation and medical fees

- Analyse loss of income and debts to be paid

- Determine the percentage of the expected cost that your certificate and savings will cover

- Consider medical inflation of 15% annually

The general rule of thumb for minimum coverage is at least three years’ worth of your annual income. FWD CI First offers critical illness coverage which is designed to reduce complexity and constraints that suit your financial needs. Reach out to our Agent to find out more.