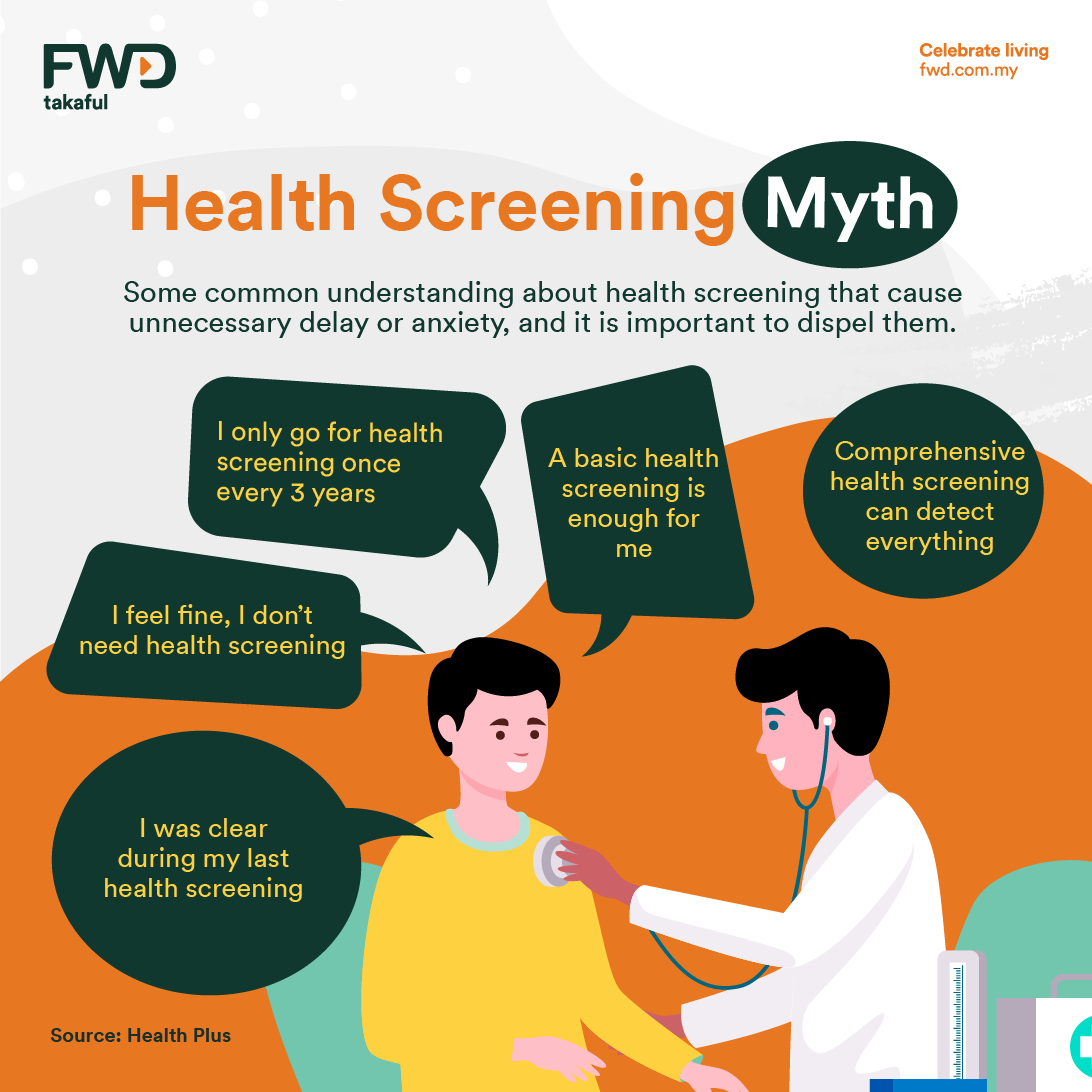

Some common ideas about health screening cause unnecessary delay or anxiety, and it’s important to dispel them.

Here are the common assumptions about health screening, and the truth about them:

1) I was clear during my last health screening – that means I’m safe and don’t need to screen again – Your last screening will only pick up health issues that were present then. Regular health screening is needed to detect conditions that may have developed after your previous screening.

2) I only need to go for health screening once every 3 years – The frequency of health screening should be based on the recommendation of your doctor. Your doctor will assess you and make personalised recommendations based on your risk factors, eg. age, race, gender, family history and personal medical history.

3) A basic health screening is enough for me – there is no one-size-fits-all screening package, and screening tests done should be tailored to every individual, taking into account their risk factors. The basic health screening package, in general, is for a young individual without any risk factors.

4) I feel fine, I don’t need health screening – Health screening is different from diagnostic tests, which are done when someone is already showing signs or symptoms of a disease. It allows problems to be treated early, increasing chances of recovery.

5) Comprehensive health screening can detect everything – Some diseases can only be picked up by specific tests which are invasive or come with certain risks and side effects. These tests are only offered to patient who experiences signs and symptoms of the disease.

While the tests used in a health screening are the best available at the point of time, they cannot predict results with 100% accuracy. This means that health screening might still fail to pick up certain diseases such as cancer. Thus it’s important for you to safeguard your health with a plan that enables you to face uncertainties with a peace of mind. FWD Takaful has recently launched FWD CI First, a plan designed to reduce complexity and constraints for critical illness protection. The plan also offers other benefits such as Waiver of Contribution, Death coverage and optional Maturity Reward benefit. Contact our Agents to know more.