Setting aside 20% of your income as savings may sound difficult if you don’t plan your expenses well. So how do you do it?

The biggest problem we have when it comes to finances is the lack of financial planning. It’s important to do some self-reflection and look at our finances to figure out how we can cut and trim to match our current cost of living. Don’t spend more than what you earn! And the best way to do that is to keep track of what you spend.

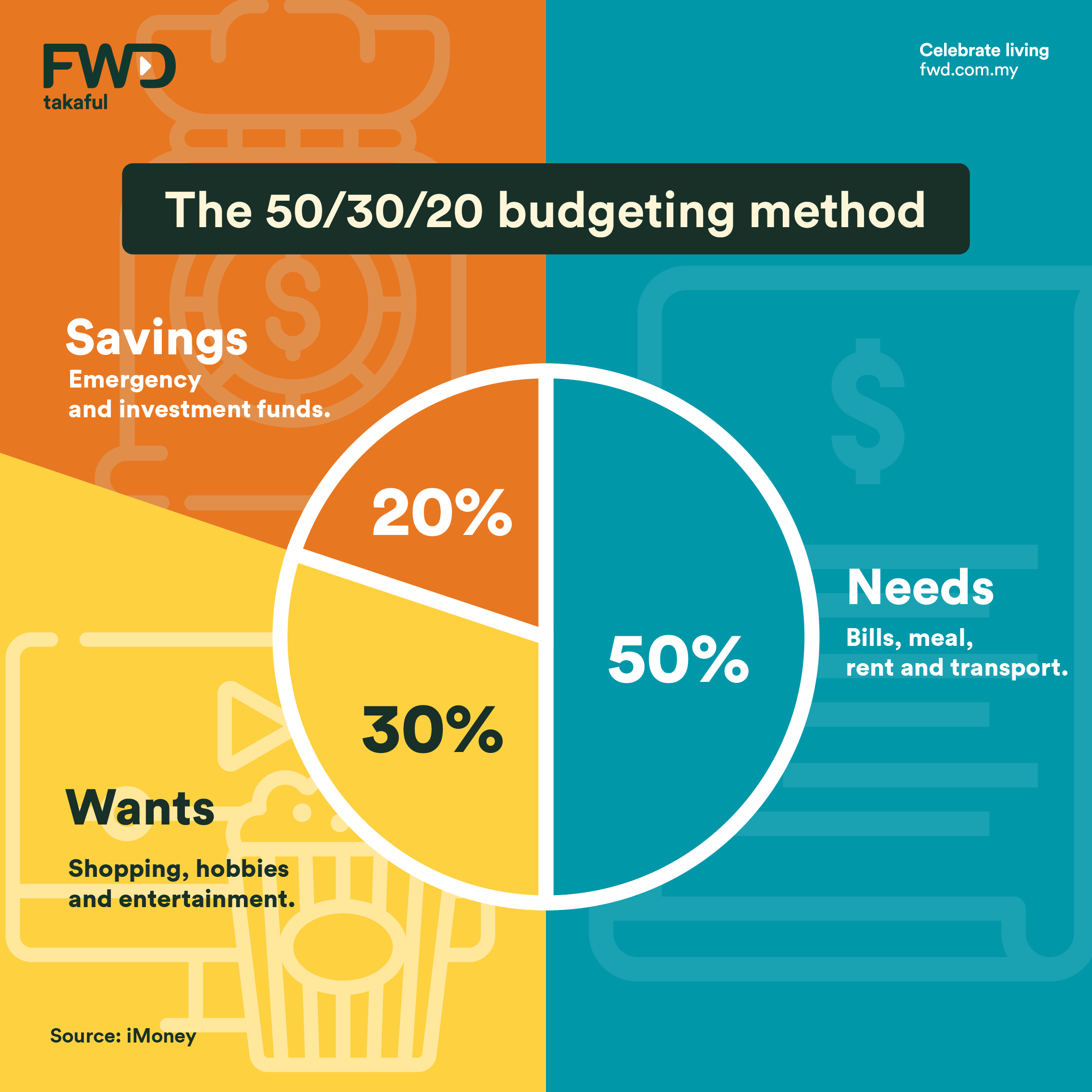

Ever heard of the 50/30/20 budgeting method? If you haven’t, then this post will help you to understand better so that you can plan your finances better. Although this budgeting method sounds simple, it takes some discipline to stick to it.

A smart way to save for rainy days while investing is to get an investment-linked plan like FWD Invest First. Maximise your wealth and protect yourself with a plan that caters to your needs. Reach out to our Financial Wealth Consultant to learn more about FWD Invest First.